When planning to expand, invest, or manage cash flow, securing a business loan can be a vital step for entrepreneurs. However, understanding the repayment structure, interest costs, and monthly EMIs can be challenging without the right tools. This is where a business loan calculator (also referred to as an industry loan calculator or business loan EMI calculator) becomes a game-changer.

In this guide, we’ll answer the most frequently asked questions about business loan calculators so that you can make informed borrowing decisions.

1. What is a Business Loan Calculator?

A business loan calculator is an online tool that estimates the monthly EMI (Equated Monthly Instalment) for a loan. By entering basic details such as loan amount, interest rate, and tenure, the calculator quickly provides:

- Monthly repayment amount (EMI)

- Total interest payable

- Overall repayment amount

This tool saves time compared to manual calculations and eliminates errors, giving you a clear view of your financial obligations before committing to a business loan.

2. How Does a Business Loan EMI Calculator Work?

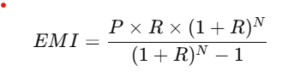

A business loan EMI calculator uses a standard formula:

Where:

- P = Loan amount

- R = Monthly interest rate

- N = Loan tenure in months

3. Why Should You Use a Business Loan Calculator?

Here are the main benefits:

- Quick Calculations – Instant EMI results with no manual effort.

- Better Loan Comparisons – Compare different lenders and industry loan calculators to find the most affordable plan.

- Avoid Surprises – Understand total repayment before signing any loan agreement.

- Plan Cash Flow – Align EMIs with your business revenue cycle to avoid financial strain.

4. Should I use a company loan calculator for all kinds of loans?

Yes. Most calculators work for:

- Term Loans – Fixed repayment schedules.

- Working Capital Loans – Short-term funding for operational needs.

- Equipment Loans – Financing for machinery or tools.

- Industry-specific loans – For manufacturing, retail, healthcare, or service-based businesses.

While the core formula remains the same, interest rates and repayment flexibility may differ depending on the loan type.

5. Is the Result from a Business Loan Calculator Always Accurate?

The EMI results from a business loan EMI calculator are accurate based on the inputs you provide. However, actual repayments may differ slightly due to:

- Processing fees

- Prepayment charges

- Variable interest rates (in case of floating-rate loans)

Always confirm details with your lender before finalizing a loan.

6. What is the Difference between a Business and an Industry Loan Calculator?

An industry loan calculator often includes features tailored to specific sectors. For example:

- Manufacturing loan calculators may factor in machinery depreciation.

- Retail business calculators might include seasonal revenue adjustments.

- Service sector calculators allow for flexible EMI schedules.

In contrast, a general business loan calculator focuses purely on EMI, interest, and total cost of borrowing without industry-specific factors.

7. Can I Reduce My EMI Using the Calculator?

Yes, you can try:

- Increasing Loan Tenure – Spreads repayment over more months, lowering EMI.

- Negotiating Lower Interest Rates – Even a 0.5% reduction can save thousands over the loan period.

- Part Prepayment – Use extra income to reduce the principal amount.

By experimenting with different inputs in the business loan EMI calculator, you can identify the most cost-effective repayment plan.

8. Do Lenders Use the Same Calculators as Online Tools?

Most lenders have their own in-house EMI calculators, which are similar to public online versions. The only Difference is that they may include:

- Bank-specific interest rates

- Additional fees

- Loan-specific eligibility criteria

Using an independent business loan calculator first allows you to compare offers before approaching a bank or financial institution.

9. Pro Tips for Using a Business Loan Calculator Effectively

- Always Input Accurate Rates

Use the exact interest rate offered by your lender, not just an estimate. Even slight differences can change your EMI significantly.

- Experiment with Tenure

Test shorter and longer repayment periods to see the trade-off between lower EMIs and higher total interest.

- Account for Hidden Costs

Some business loans come with processing fees or insurance costs. Factor them into your budget even if they’re not shown in the calculator.

- Compare Across Lenders

Use multiple calculators — including industry loan calculators — to compare offers before finalizing your decision.

- Check Prepayment Benefits

Some lenders allow early repayment without penalty, which can save on interest.

10. Quick FAQs About Business Loan Calculators

Q1: Can I use a business loan calculator for loans in foreign currency?

Yes, as long as you know the exact interest rate and tenure. Just convert the amount to your currency for consistency.

Q2: Will my EMI remain the same throughout the loan period?

For fixed-rate loans, yes. For floating-rate loans, EMIs may change based on market interest rates.

Q3: Is a business loan calculator free to use?

Most online versions are free and don’t require registration.

Q4: Can I use the calculator for partial prepayment scenarios?

Some advanced business loan EMI calculators include prepayment options, but for basic ones, you’ll have to adjust the principal amount manually.

Q5: Does using a calculator affect my credit score?

No. Calculating EMIs is just a planning step and has no impact on your credit profile.

11. Common Mistakes to Avoid When Using a Loan Calculator

- Ignoring Additional Charges

Some industry loan calculators don’t show processing fees, insurance, or GST. Always check these separately.

- Using Estimated Interest Rates

Relying on generic rates can give you unrealistic EMI figures.

- Not Considering Prepayment Options

If your business is seasonal, you might have surplus income in certain months — prepayments can save big on interest.

- Only Checking One Lender

The first offer is rarely the best. Use multiple calculators from banks, NBFCs, and independent sites.

- Focusing Only on EMI Amount

A lower EMI could mean a longer tenure and a higher total interest balance, both of which are factors.

12. Bonus Checklist Before Applying for a Business Loan

- Have I calculated EMIs for at least three different lenders?

- What is the total interest cost over the loan period?

- Is my repayment plan aligned with my business’s cash flow cycle?

- Have I checked the prepayment and foreclosure terms?

- Have I reviewed both business loan calculators and industry loan calculators for better accuracy?

- Is my credit score strong enough to negotiate better interest rates?

Final Thoughts

A business loan calculator is an essential tool for any entrepreneur considering a loan. It simplifies EMI estimation, helps compare options, and supports better financial planning. Whether you’re using a general business loan EMI calculator or an industry loan calculator, the key is to test different scenarios and align your repayment schedule with your business growth strategy.

Smart borrowing starts with knowing your numbers — and a loan calculator makes that easy.